22 wonderful 4 Pricing Methods For Aggressive Benefit

[ad_1]

Enterprise leaders typically confuse pricing strategies with pricing methods, so it is vital for us to differentiate sharply between the 2. Pricing strategies yield a value quantity as a finite output. These outputs can fluctuate considerably, relying on the knowledge sources used.

Pricing methods demand that leaders look past costs – past the numbers – to take everything of their present and future market conditions into consideration, slightly than focusing narrowly on one enter or one methodology to the exclusion of different info. Pricing methods specific intentions and supply steering and route. They’re subjective and require astute judgment.

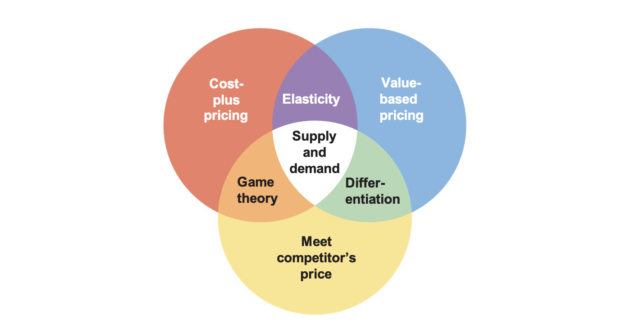

The following step in going past costs and growing a pricing technique is to have a look at the mixtures of the three info sources. Value, com- petition, and worth can generate necessary and extra highly effective insights together than in isolation. The intersections present the 4 pure overlaps that lead to sensible frameworks backed by massive our bodies of financial principle.

The frameworks on the respective overlaps – elasticity, differentiation, sport principle, and provide and demand. Every of those frameworks can both facilitate or hinder strategic pricing choices, relying on how enterprise leaders apply them. Under we elaborate on the 4 frameworks on the intersections.

Value Elasticity: The elasticity framework lies on the intersection of price and worth, as a result of price and willingness to pay are the 2 inputs essential to calculate an optimum value based mostly on elasticity. Value elasticity offers a numerical reply to questions corresponding to “What’s going to occur if we increase costs by 5%?” or “How a lot of a value reduce would we have to increase volumes by 10%?” as a result of it captures the presumptive cause-and-effect relationship between costs and volumes. Modifications in value alter a purchaser’s perceived worth derived from an providing. Incorporating price info permits a management crew to grasp the monetary penalties of these value adjustments.

Value Differentiation: This framework lies on the intersection of competitors and worth, as a result of an organization can differentiate costs relative to rivals and relative to its personal merchandise. This framework combines insights from the financial theories of value discrimination and behavioral science. Value discrimination refers to promoting the identical supply to totally different prospects at totally different value factors, both straight (first-degree value discrimination) or via reductions (second- and third-degree discrimination). We predict this attitude is simply too restrictive from a sensible standpoint. That’s the reason our definition of differentiation is broader: the mix of value discrimination and behavioral science. In different phrases, differentiation means value variation and product variation. Behavioral science research how prospects select amongst an organization’s numerous provides. It has highlighted quite a few biases that people have when making such selections. These biases transcend and sometimes contradict the numerical rationality of classical economics.

Sport Idea: The sport principle framework lies on the intersection of prices and competitors, as a result of an organization solely wants prices and competitor value info to outline optimum costs in that framework. It applies primarily when an organization’s costs depend upon the pricing habits of some particular person rivals whose choices all have very comparable worth. In such circumstances, the sport principle framework helps leaders make better-informed unilateral strikes, as a result of they perceive the consequences these strikes may have on rivals and on their very own firm.

Provide and Demand: This framework lies on the intersection of all three sources of data. The market’s provide curve is, by definition, based mostly on the prices, capacities, and costs of each competitor. The demand curve, in the meantime, is a operate of both the aggregated willingness to pay of people or the worth they derive. This framework tends to use very nicely when prices, competitors, and worth have a number of important and simultaneous drivers, with time often crucial one.

Contributed to Branding Technique Insider by Jean-Manuel Izaret and Arnab Sinha. Excerpted from their ebook: Sport Changer: How Strategic Pricing Shapes Companies, Markets, and Society with permission from the writer, Wiley. Copyright © 2024 by The Boston Consulting Group, Inc. All rights reserved.

The Blake Venture Can Assist You Construct A Greater Aggressive Future In The Strategic Model Storytelling Workshop

Branding Technique Insider is a service of The Blake Venture: A strategic model consultancy specializing in Model Analysis, Model Technique, Model Licensing and Model Training

FREE Publications And Assets For Entrepreneurs

Publish Views: 72

[ad_2]

2022 wonderful 4 Pricing Methods For Aggressive Benefit